Underrated Ideas Of Info About How To Find Out Your Unique Taxpayer Reference

The reason why some may find the prospect of finding out their taxpayer identification number daunting could be because there are two main types of abbreviations.

How to find out your unique taxpayer reference. Find a lost utr number you’ll automatically be sent a unique taxpayer reference ( utr) when you: This can be done on hmrc’s website. When you are inside your.gov you’ll be able to find your unique taxpayer reference either:

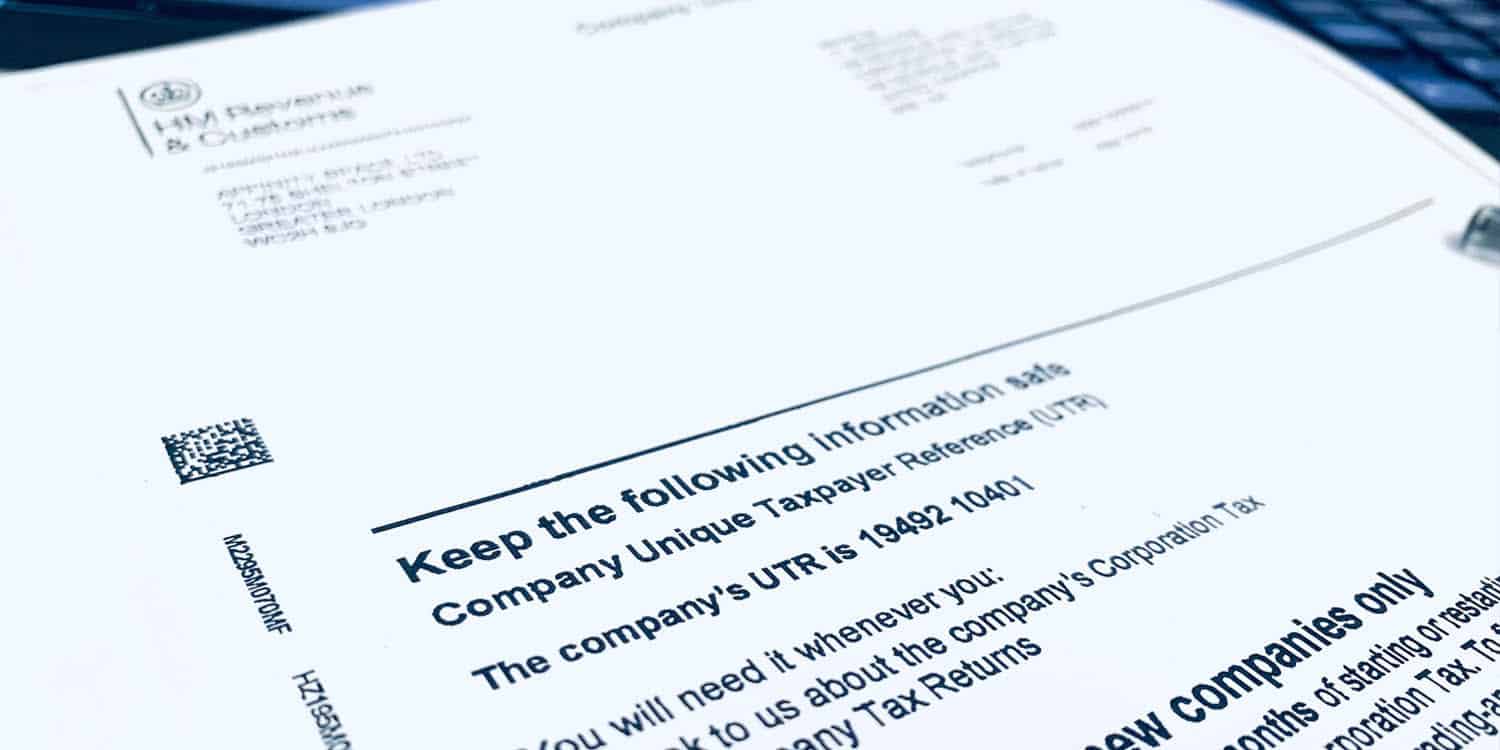

Fill in, print out and post the form after you’ve registered, you’ll receive your unique taxpayer reference ( utr) number in the post within 10 working days (21 if you’re abroad). If you can’t find your unique tax reference, all is not lost. All utr numbers have 10 digits,.

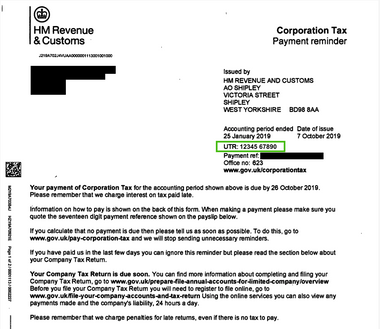

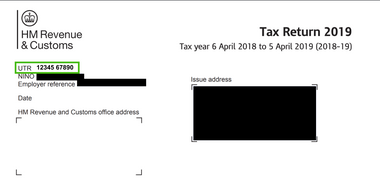

Your company’s unique tax reference will be printed next to a heading like ‘official use’, ‘tax reference’, or ‘utr’ at the top of the first statutory letter delivered from hmrc. Where to find your unique taxpayer reference (utr) number or corporation tax utr number. The most common way to register for self assessment is online through hmrc’s website, but,.

You can find your utr number online in your government gateway account. How do i find my unique tax payers reference? When you login you will be able to see your tax.

A unique taxpayer reference (or utr) is a number that hmrc uses to track tax payments made by sole traders and companies. Using the link below you can request your unique taxpayer reference from hmrc, it will be sent to your registered office and normally take about 15 days to get there. This is your personal online account that you can set up with hmrc.

Andrew jordan explains how to find and request a company utr (unique tax reference).if you have any questions or need any help please call us 01482 427360, e. If you have an hmrc login (also. Take a look for it on previous tax returns you have filed;